IRMAA: Income Related Monthly Adjustment Amount

By Erica Beaudry, Medicare Advisor

Published in Northampton Living May 2025

EXPERT CONTRIBUTOR

ERICA ANNE BEAUDRY

Medicare Advisor

EA Financial Solutions

413 626 9906

info@eafinancialsolutions.com

www.eafinancialsolutions.com

Today we break down IRMAA, or the Income Related Monthly Adjustment Amount some folks pay for their Medicare Parts B and D coverage. Basically, those with a higher income pay more.

IRMAA is a surcharge determined by the Social Security Administration and based on income reported 2 years prior. The amount is calculated annually; if your income changes, so might your IRMAA. The base rate for Medicare Part B in 2025 is $185.00. Depending on your modified adjusted gross income as reported on your IRS tax return from 2 years ago you may have to pay the standard Part B premium plus an IRMAA.

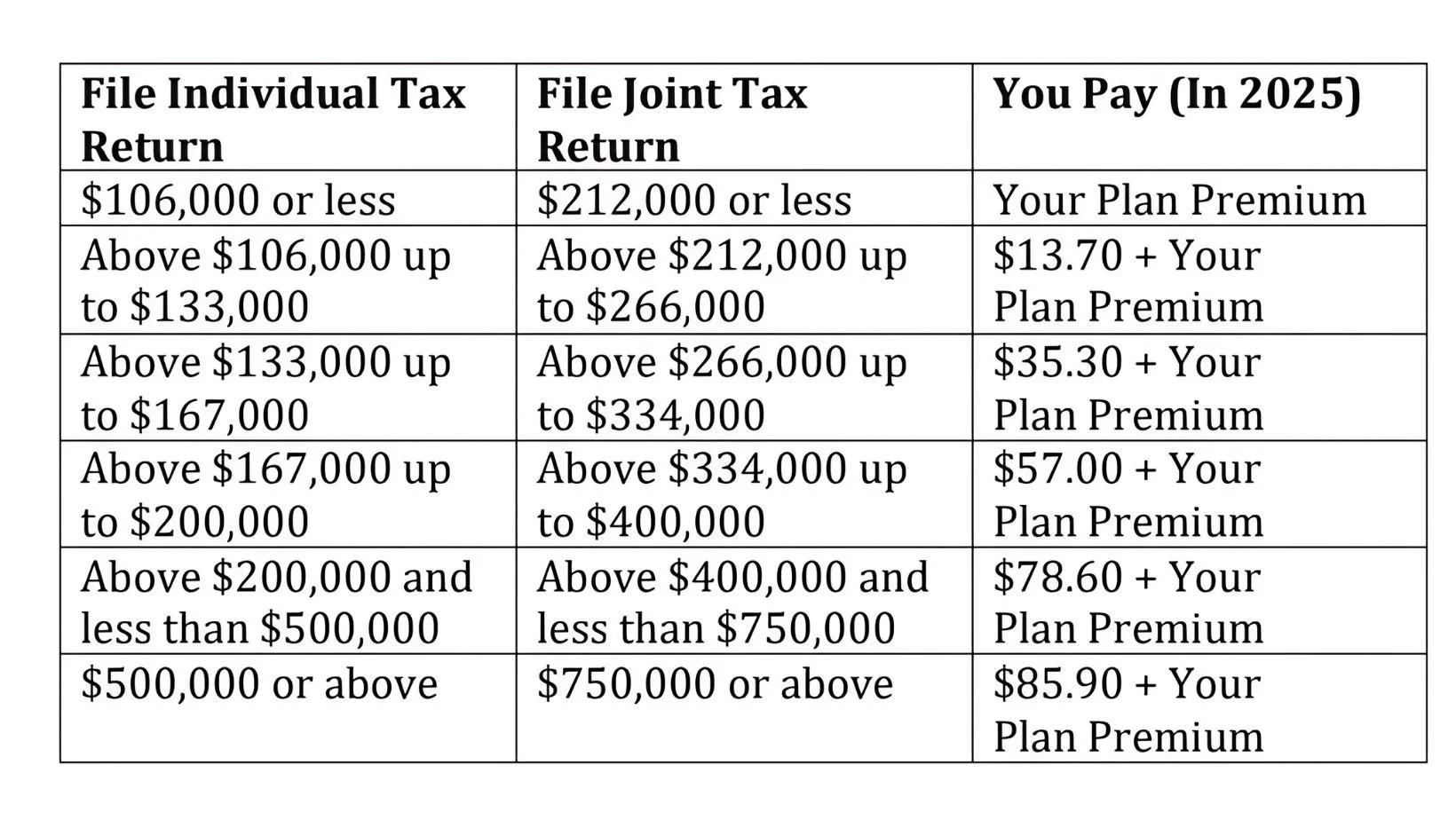

The income brackets for the 2025 Part B IRMAA are as follows:

If the Social Security Administration determines you owe an IRMAA, you will receive a notice from them for the amount of your new premium and the reason for their determination. If you disagree with their determination, you have 60 days from the date of notice to appeal. Life-changing events such as loss of income, the death of a spouse, marriage or divorce could be grounds for a redetermination, as well as inaccurate or outdated tax information.

IRMAA also comes into play with your Part D or Drug coverage. The same set of parameters are used to calculate the surcharge for Part D. Remember is that the Part D IRMAA is in

If the Social Security Administration determines you owe an IRMAA, you will receive a notice from them for the amount of your new premium and the reason for their determination. If you disagree with their determination, you have 60 days from the date of notice to appeal. Life-changing events such as loss of income, the death of a spouse, marriage or divorce could be grounds for a redetermination, as well as inaccurate or outdated tax information.

IRMAA also comes into play with your Part D or Drug coverage. The same set of parameters are used to calculate the surcharge for Part D. Remember is that the Part D IRMAA is in addition to any premiums associated with your Part D coverage but is paid directly to the Social Security Administration the same way you pay for your Part B premiums.

The income brackets for the 2025 Part D IRMAA are as follows:

If your head feels like it is spinning after reading this, don’t worry. Take the headache out of understanding Medicare by working with a professional who will help you sift through all the details that come with enrollment and coverage.

Independent Medicare specialists do not work for insurance carriers. Instead, we provide an independent, unbiased view of insurance options available to seniors and Medicare recipients at no cost to the people we serve. We focus on Medigap, Medicare Advantage and Prescription Drug Plans. Our service doesn’t end when you enroll in a plan. We live in your community and are here to answer your questions year-round.

Disclaimer: I do not work for and I am not affiliated with Medicare.